Gui. Let’s start at the start. What is Mesh ID?

The best way to describe it is a collaborative information sharing network. The key aim of Mesh ID is to reduce the duplication of work that exists across different financial services providers surrounding an individual or corporate client.

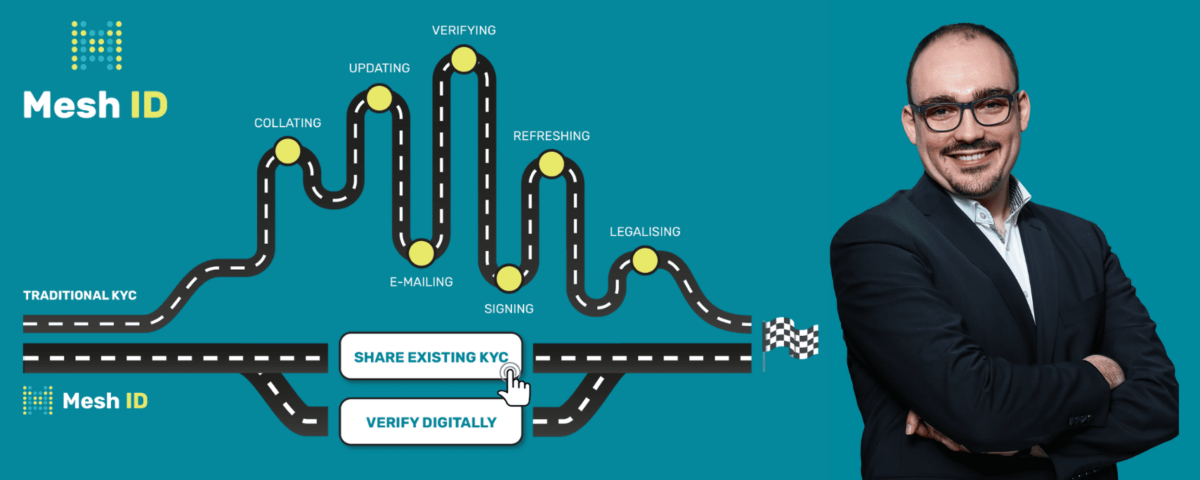

If you look at it from the perspective of, for example, a fund investor. They will inevitably invest in multiple funds, as well as engage with other service providers. Every time they do so, they are asked for the same information about who they are, over and over and over again. They end up having to collate and send the same information multiple times to various parties.

With Mesh ID, once the investor is onboarded by a service provider using Mesh ID, the investor is given control of their information in the form of a digital verified identity, a ‘passport’ of sorts, which they can then use to identify themselves with the next provider.

It’s extremely easy for them to provide their information a second time. It takes just a matter of a few clicks. What is a great added benefit, is that any new information which is collected is re-shared, at the request of the investor, with all previous service providers. All providers therefore have the most up-to-date information about their client at any given time.

And one of the most important benefits for the investor is that their ‘passport’, that verified identity, remains in their possession and control so it is up to them who they share parts of that information with in the future.

So, rather than go through the same process five or ten or more times, it’s done just once? That would seem to make a lot of sense for both the client and the service provider.

Yes, that’s correct. And so whether you are an investor or other type of client, you’ve got yourself a fast-track passport to the financial services industry. It’s truly a game changer.

It sounds so obvious. So why has it not been done before?

Well, the key challenge is that, to use the passport analogy, you need institutions to accept that passport. With travel, we know countries and border controls around the world will accept your passport because it’s issued by a trusted authority. But when it comes to financial services, this kind of thing doesn’t exist. There is a need to create a local, or regional, or better yet global standard that’s legitimate. This, however, is extremely hard to do without placing trust in one central organisation.

And I think that’s our main value add on the technology side. We broker that trust between parties so that everyone that’s on the Mesh ID network can trust that the information that they’re receiving is actually coming from the source that it claims to be coming from, and has not been altered en route.

There are other jurisdictions like Dubai and Sweden who have similar solutions in place. It hasn’t been done in Jersey before because you need to get a bunch of organisations together around the same table to discuss and to agree on how to share information. We managed to break that barrier by using the structure provided to us by the Digital Jersey Sandbox, which helped us get everyone around the table in a less formal way than you would normally see in these kinds of working groups. We were able to talk about the issues, solve them together, and put in place only the necessary controls and governance, and nothing more. This allowed us to actually get things done, rather than just talk about what needs to be done.

This kind of large-scale collaboration initiative has been tried elsewhere before, but what starts small soon has larger organisations getting involved and competing interests at play, so no progress gets made. The fact that we brought together industry and the regulator, meant we could produce something Jersey could trust, and in record time.

Is there a plan to roll this out elsewhere?

Our motto is always to think big, act small and move fast, and that’s very much what we’ve done. We’ve started in Jersey where there’s a big demand for a product such as this, and the island is the perfect environment in which to innovate and actually create these kinds of collaborative solutions.

To have people around the same table, with support from the regulator, means we can get things done well and quickly. You don’t get that level of engagement in other countries, Jersey is really unique in that way.

Since participants on the network will benefit from more engagement, we and the wider Mesh ID community plan to go global with it. We’re looking at expanding out to a couple more jurisdictions that are relevant in the months to come.

By accident or by design, your timing is good, because there’s such a focus right now on improving productivity in Jersey in the wake of the pandemic. This could be huge for the finance sector.

Absolutely. It’s one of the few silver linings of this pandemic. I think the events of the past year have brought these issues to the surface. People are looking at costs and considering whether there are more efficient ways to do things. We also offer technologies built into Mesh ID to verify identities and addresses digitally, without the need for notary visits or physical in-person verifications. We offer these technologies to help our members automate the most painful parts of their onboarding process, but have become even more relevant during the pandemic.

So, instead of asking for a certified copy of someone’s passport and asking them to actually go and physically visit a notary, we provide technology plugged in to Mesh ID to say, you know what, why don’t you just generate a link for them, send them the link and they’ll do everything on their mobile within a couple of minutes. At the end of the 2-minute process, you have a regulator approved biometrically verified identity.

Digital Jersey talks a lot about being an agency which helps remove the roadblocks and barriers to getting things done, to make it easy for those wanting to innovate. Is seems that’s what you’re doing, too.

Yes, you could say that. It’s no coincidence that we partnered with Digital Jersey and were invited into their Sandbox proposition. It meant we’ve been able to foster this kind of fast collaboration in Jersey, which is a way is what Mesh ID is all about.

Traditionally, organisations set up very, very strong high castle walls around themselves in terms of data and process. While we all agree it’s so important that everyone has the right and most up-to-date information about a client to determine risk, by closing down their own information and knowledge that exists inside their organisation they can actually be creating a weakness because there are bad actors who thrive in that gap between each organisation.

Often times bad actors will end up hopping between service providers, signing up to launder money between multiple entities because providers don’t have visibility of the bigger picture. It’s like someone who insures a car with multiple insurance providers and makes multiple claims on the same accident. Mesh ID helps to break some of those barriers between financial services providers and brings more transparency to that process.

So those who operate as a silo thinking that makes them stronger, you say, may actually be missing a trick. For those who haven’t considered learning more about Mesh ID, what would you say?

Well, I think the main thing is to take a good look at how regulated institutions operate today, especially in the era of Covid, and realise that, in fact, a lot of menial collection and verification work that you do is work that other organisations have already performed on the same client. It doesn’t need to be this way. It’s not a problem any one organisation can solve alone, however. We all need to be able to offer clients a better approach to onboarding that will enable them to launch funds much quicker and with less pain for all involved.

I urge people to take a broader look at how we can solve this issue across the industry for the betterment of everyone. Come and join Mesh ID, as It will benefit the way we deliver financial services as a whole and will make Jersey an even more attractive jurisdiction. We won’t replace your current systems, but rather compliment them by feeding them good quality, reliable data.

What could be a better proposition than to offer your clients a way of taking back control over their information, especially in the privacy obsessed era we live in, reducing the pain of interacting with their providers, all while reducing the amount of menial collection and verification tasks your staff perform? It’s really a win-win-win. That’s the power of Mesh ID.