In this month’s Member Spotlight, we catch up with Susan Paterson, Head of Komainu’s Jersey Office. Discover more about the company’s journey and how they’re setting new standards in the digital asset space.

Tell us a little bit about yourself, your role:

I currently serve as Head of Komainu’s Jersey Office in addition to being Group Corporate Secretariat. As Head of Jersey, I lead on all strategic initiatives that bolster Komainu’s presence and impact in the region. As Secretariat, I am responsible for assuring the company stays in compliance with its statutory obligations across jurisdictions.

My career started in traditional financial services, followed by serving as a Senior Examiner for the Jersey Financial Services Commission and then transitioning to the world of digital assets. I have held senior positions across industry leaders including Brevan Howard, State Street and Credit Suisse.

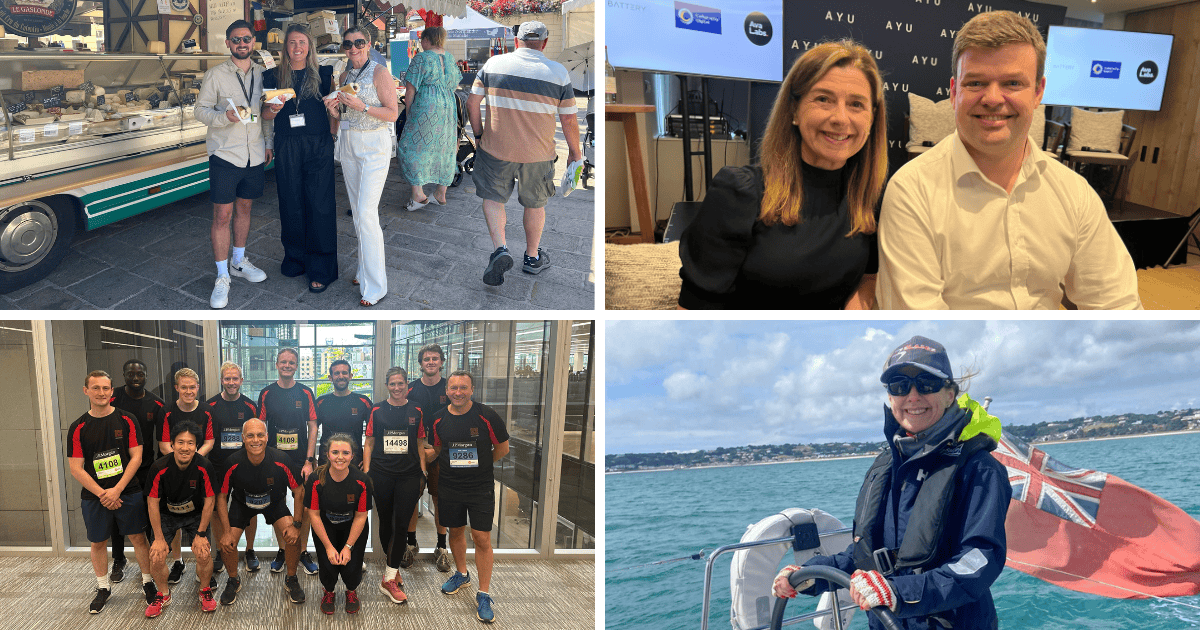

In my free time, I enjoy paddle boarding, sailing and anything fitness related, whilst balancing this with enjoying the delights of Jersey’s amazing restaurants.

For anyone who doesn’t know, what does Komainu do?

Komainu is a digital asset custodian, offering secure and regulated storage solutions specifically designed for institutional investors. Leveraging advanced technology and strong regulatory frameworks, we enhance the safety and integrity of digital assets. Our journey began as a joint venture between Nomura, Ledger, and CoinShares in 2018, with our services officially launching in 2020. Strategically positioned to capitalise on the growing demand for institutional-grade custody solutions in the digital asset space, we aim to be at the forefront of providing trusted custodial services. Since inception, Komainu has experienced steady growth and we have been enhancing our institutional product offerings. Alongside our core custody services, we now offer custodial staking and Komainu Connect, our collateral management platform.

How long have you been a member of Digital Jersey?

As a relatively new member this year, Komainu has been working with the excellent Digital Jersey team and meeting other members. Specifically, Komainu is thrilled to support Digital Jersey’s mission to further promote Jersey as a thriving destination for digital services and infrastructure. We are also keen to demonstrate Jersey’s viability as the jurisdiction of choice for digital asset service providers and contribute to the broader conversation about digital assets and their impact on the future of finance.

What do you like most about being a member?

Being a member of Digital Jersey offers Komainu access to excellent facilities that enable a varied set of fintech operators and innovators to collaborate effectively. The academy provides extensive training and mentoring options covering many aspects of the ecosystem, benefiting both employees of established businesses and new entrants into the space. This comprehensive support fosters local job opportunities for those aspiring to build a career in fintech. Additionally, the team at Digital Jersey, with special recognition to Edmund Hatton, has played a crucial role in raising Komainu’s profile in Jersey. It has been an absolute pleasure working with the Digital Jersey team this year, and we are excited about organising an event at the academy in the near future.

How would you describe Komainu’s workplace culture and what does the team do together outside of work?

Komainu has offices in Dubai, London and is headquartered here in Jersey. We are a relatively small team, so workplace culture is characterised by a strong sense of collaboration and innovation. Our team is composed of seasoned professionals from both traditional finance backgrounds and digital asset natives, all sharing a common interest and belief in the future of digital assets and technology. This fosters a dynamic and inclusive environment where ideas and expertise are freely exchanged, driving our collective growth and success.

Outside of work, Komainu teams in their various locations often engage in social activities to build camaraderie and strengthen team bonds. Monthly team socials and sporting events provide us opportunities for relaxation and fun. For instance, most recently, our London Komainu team participated in the annual JP Morgan Corporate Challenge, demonstrating our commitment to teamwork and fitness.

What has been a significant highlight for Komainu so far?

One of the most significant highlights for Komainu was receiving regulatory status in Jersey in 2019, a milestone achieved well ahead of many competitors in the industry. This early regulatory approval provided institutional clients with the assurance that Komainu met stringent standards of governance and had a robust risk management framework in place to secure their assets. Since then, Komainu has successfully expanded its geographical footprint, gained more regulatory licenses and established a presence in the UK, Europe, UAE, and Asia. Alongside this growth, Komainu has continued to evolve its product offerings to meet the diverse needs of its institutional clients, solidifying its position as a trusted and innovative leader in digital asset custody.

What exciting projects have your team been working on recently?

2023 was a pivotal year for our business. Firstly, we introduced Komainu Connect, a solution that reduces counterparty risk by removing the need to store digital assets with a third party trading venue or lending platform. Komainu Connect allows clients to securely deposit digital assets into a segregated collateral wallet, and via our partners, trade, borrow or lend while your assets remain in custody.

Last year, we also entered partnerships with OKX, Copper, Hidden Road, and Gate.io.

Notably, the partnership with OKX was a collaboration between Komainu as well as Jersey-headquartered asset manager CoinShares. To address the challenge of counterparty risk, the three firms joined up efforts to offer an innovative solution via a robust tripartite agreement designed to mitigate counterparty risk. The arrangement incorporates clear legal frameworks that define rights, responsibilities, and mechanisms for dispute resolution, enabling institutional traders to access crypto liquidity whilst safeguarding their assets. Later this month, we’ll be launching the next phase of our partnership with OKX, opening the solution to more clients, offering more scale, a delegation model and support for new trading products.

Digital assets have firmly established their presence in the market, and so far, 2024 is a year that will be marked by institutional participation, improved regulatory clarity, and a stronger ecosystem that has the potential for wide-ranging benefits. Komainu is committed to leading the way by continuing to provide clients with secure, compliant, and innovative custodial solutions that stand the test of time.

How do you see digital assets reshaping the future of finance, and what excites you most about these changes?

Digital assets are set to revolutionise the future of finance by enhancing transparency, efficiency, and accessibility within the financial ecosystem. The integration of blockchain technology facilitates faster and more secure transactions, reducing the reliance on intermediaries and cutting costs. At Komainu, our mission revolves around building market infrastructure and providing trusted custodial services tailored to meet the evolving needs of institutional investors. The adoption of digital assets by institutions promises to fortify and streamline financial markets, introducing fresh investment opportunities and enhancing liquidity.

Through our secure and regulated custody solutions, Komainu empowers institutions to navigate the digital asset landscape with confidence. The potential for innovation in areas such as tokenisation underscores the transformative impact digital assets could have on the global financial landscape. At Komainu, we are dedicated to leading these advancements, continually refining our offerings to address the increasing demands of institutional clients and supporting the growth of a more resilient and efficient financial system.

What advice would you give to someone wanting to start their career in Fintech?

For those looking to start a career in Fintech, it is essential to develop a strong foundation in both finance and technology. This can be achieved through formal education, certifications, and practical experience in relevant fields. Additionally, staying informed about the latest industry trends and advancements is crucial. Networking with industry professionals, attending conferences, and participating in online forums can provide valuable insights and opportunities. Fostering a mindset of continuous learning and adaptability will help aspiring Fintech professionals navigate this rapidly evolving space.